Our Residential Property fees

We are a regulated law firm, meaning that we are governed and monitored by the Solicitors Regulatory Authority.

We MUST comply with the SRA’s Principles and Code of Conduct, whereas unregulated solicitors and licensed conveyancers do not. Our obligations include, but are not limited to, us having to:

- Act in the best interest of each client;

- Provide a service which is competent and delivered in a timely manner;

- Take account of our client’s attributes, needs and circumstances;

- Make sure the lawyers managing and supervising the matter have the requisite legal and practical knowledge to carry out the work and that they keep their professional knowledge and skills up to date;

- Safeguard money and assets entrusted to us by clients;

- Keep the affairs of current and former clients confidential; and

- Provide transparency in relation to our fees and the service we provide.

In addition, the firm and all our conveyancers are certified members of the SRA’s Conveyancing Quality Scheme. The CQS provides further obligations on us and dictates certain best working practices which we must adhere to.

We value our clients and therefore act proactively to assist them in achieving their objectives.

The information below is set out to assist you in deciding whether you want to instruct us in relation to a sale or purchase of a residential property or in relation to mortgaging or re-mortgaging your property. Our fees are fixed, apart from where it is clearly stated otherwise, and therefore the information below provides you with a comprehensive list of our fees.

Please contact us to obtain a quote. You are free to accept or refuse any quote that we provide you.

Residential Sale and Purchase Fees

The following fees are based upon the standard sale or purchase of a residential freehold property registered at HM Land Registry, owned by the occupiers with or without a mortgage, but no other borrowing or lending, marketed with estate agents on the open market and the source of funds are easily checked.

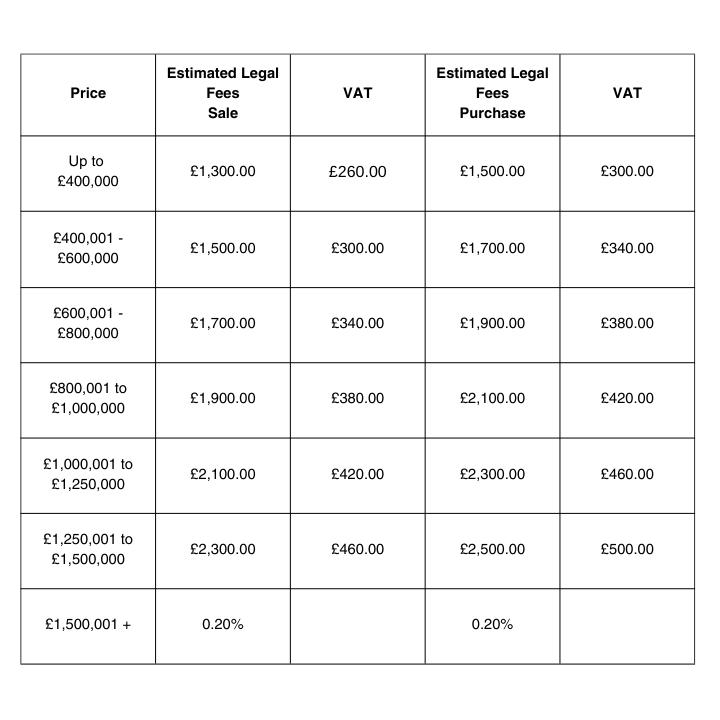

Freehold residential sale and purchase fees

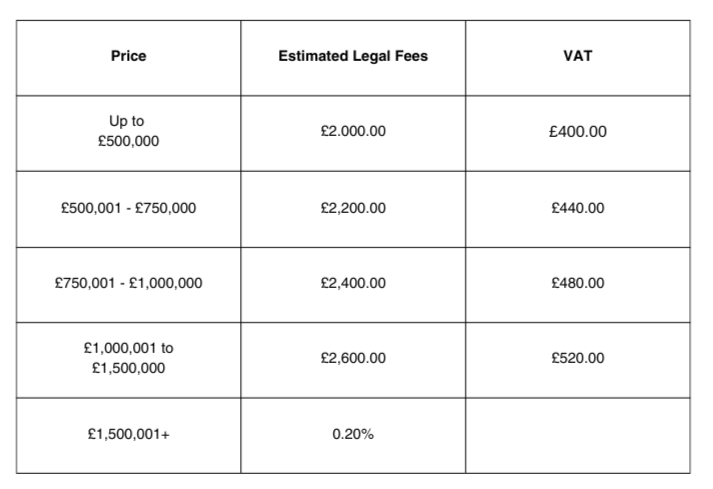

Leasehold residential sale and purchase fees

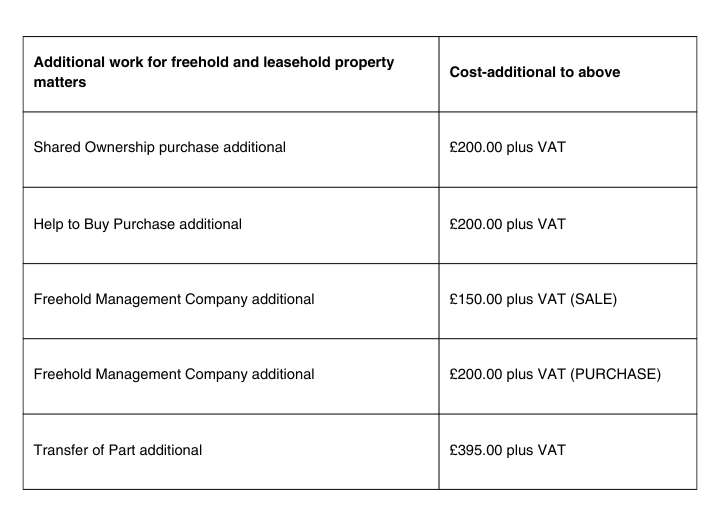

Additional fees for freehold and leasehold property matters

The additional fees set out below will only be due on certain transactions. You will be advised, at the earliest opportunity possible, where such charges apply to you.

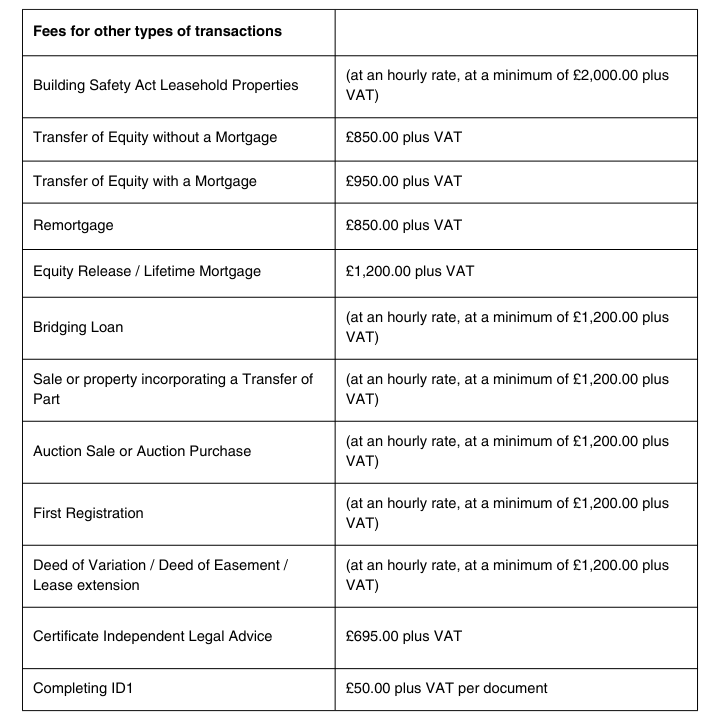

Fees for other types of transactions

Although the work below is seldom linked to a sale and purchase. Where the following work is related to a sale and/or purchase, these charges are in addition to those set out above.

Where we undertake work at our hourly charge rate we charge on a time basis of six minute units and our hourly rates are:

- Partners: £365.00 per hour plus VAT

- Senior Associate: £325.00 per hour plus VAT

- Associate / Senior Executive £290.00 per hour plus VAT

- Solicitor / Chartered Legal Executive £260.00 per hour plus VAT

- Executive / Graduate Legal Executive: £220.00 per hour plus VAT

- Assistant/Paralegal: £195.00 per hour plus VAT

- Trainee Assistant: £130.00 per hour plus VAT

- Clerk rate: £110.00 to £120.00 per hour plus VAT

* Additional Charges for Leasehold Properties

These fees do not include any payment to the landlord or management company to obtain information relating to ground rent, insurance, service charge or building insurance, nor any adjustments due to a shortfall or overpayment of ground rent and service charge up to the date of completion. The fees also do not include any payment a landlord or management company may make for providing consents or certificates.

These fees do not include the cost of obtaining a lease extension.

Please note, our fees are transparent, and our legal fees and VAT all include bank transfers, electronic ID checks, verifying the other solicitor’s bank details, anti-money laundering checks, Lender Panel Administration Fee (where a mortgage is involved), our compliance checks, including verifying Source of Funds/Wealth, preparing, and submitting Stamp Duty Land Tax Forms. We will not make any additional charges as you may find at some other conveyancing firms.

ALL QUOTATIONS WILL BE VALID FOR A PERIOD OF 3 MONTHS

Disbursements

Searches – we will carry out a range of searches including a search at the local authority, a water/drainage search and an environmental/flood search. In certain parts of the country, additional searches are required. You should allow between £350 – £500 plus VAT, depending on the area.

Land Registry searches – £7.00 per title document

Bankruptcy and priority searches – £6.00 per name

Land Registration fee – Fee payable to the Land Registry to register you as the new owner of your property and any legal charges. The fee is based on the value of the property and the Land Registry’s online calculator will help you. We will always advise you of the fee when we provide our fee estimate.

Additional TAX

Tax can be payable on the purchase or sale of a residential property. The above fees do not include any payment towards tax.

The UK’s current standard rate of VAT is 20%.

Stamp Duty Land Tax will be charged on residential property purchases which is calculated using the purchase price of your property. The SDLT payable on a freehold residential purchase, by UK residents as their only residential property, but having owned one previously, for a sum of £400,000 is £7,500 as of 25 April 2023.

Capital Gains Tax may be payable on the sale/transfer of a residential property if it is not your main residence.

You are responsible for paying any tax that is due and may need to consult an accountant/tax advisor. HMRC provide tools and calculators at https://www.gov.uk/guidance/hmrc-tools-and-calculators where you will be able to obtain an estimate of the likely tax that is payable on the purchase/sale.

Timescales and stages

The average process takes between 8 – 12 weeks, however this can depend upon several factors.

The timeframe will depend upon the property, the mortgage company, any other borrowing being provided by third parties, you providing source of funds and source of wealth documentation promptly, parties in the chain, removals, funding issues, etc.

Please note that where you are purchasing a new build property or in a chain where a new build is being purchased, we cannot give a timescale as this depends on the developer; however an estimated completion date will be given by the developers’ solicitors.

A chain of sales and purchases happen where you are selling your property and buying another. The person buying your property needs to sell their one, and the people selling to you have an onward purchase – you are then part of a chain of at least 3 transactions. Each transaction can only take place when all the other parties are ready. One party can hold up the whole chain and it may be a transaction two or more away from yours, so you have limited influence.

A leasehold property purchase that requires an extension of the lease can take significantly longer, between 4 to 6 months. In such, a situation additional charges would apply.

The precise stages involved in the purchase of a residential property vary according to the circumstances. However, below are the main stages:

- Take your instructions and give you initial advice

- Check finances are in place to fund purchase and contact lender’s solicitors if needed

- Receive and advise on contract documents

- Carry out searches

- Obtain further planning documentation if required

- Make any necessary enquiries of seller’s solicitor

- Give you advice on all documents and information received

- Go through conditions of mortgage offer with you

- Send final contract to you for signature

- Agree completion date (date from which you own the property)

- Exchange contracts and notify you that this has happened

- Arrange for all monies needed to be received from lender and you

- Complete purchase

- Deal with submission of the relevant forms to HMRC and the payment of Stamp Duty/Land Tax

- Deal with application for registration at Land Registry

The precise stages involved in the sale of a residential property vary according to the circumstances. However, below are the main stages:

- Take your instructions and give you initial advice

- Issue draft contract documentation to your buyer’s solicitors

- Obtain a redemption statement from all lenders with a charge over the property

- Liaise with the selling agent, if any, with regards to the progress of the transaction

- Obtain further planning documentation if required

- Deal with any enquiries raised by your buyer’s solicitor

- Write to you with regards to any enquiries raised that we are not able to reply to

- Approve the buyer’s solicitors draft transfer

- Send final contract to you for signature

- Agree completion date (date from which you own the property)

- Exchange contracts and notify you that this has happened

- Arrange the redemption of all charges registered against the property

- Complete the sale and send the balance sale proceeds to you or if required transfer such funds to a related purchase

- Advise any selling agent of completion of the sale and pay any commission due to them.

- Send to your buyer’s the signed transfer and any other relevant documentation

The precise stages involved in a mortgage/re-mortgage of a property already owned by the borrower vary according to the circumstances. However, below are the key stages:

- Take your instructions and give you initial advice

- Carry out searches if required by your lender

- Obtain further documentation if required

- Obtain a redemption figure for any charge registered against the property, if required

- Go through conditions of mortgage offer with you

- Send a report to you on the mortgage with the mortgage deed for signing

- Agree a completion date with you

- Drawdown the mortgage funds, if required

- Arrange for all monies needed to be received from you or paid to you

- Complete the transaction

- Redeem all charges registered against the property, if required

- If applicable pay any balance funds to you

- Deal with application for registration at Land Registry

As you may appreciate, the sale and purchase of residential property is not simple. Our clients appreciate the service we offer at what people often consider to be a stressful time. We take pride in delivering an excellent service to our clients. Thanks to client reviews we are ranked as the best firm of solicitors in North Dorset on the comparison site Review Solicitors

Our team collectively haves hundreds of years of experience and deliver an exception level of service and legal advice in all matters relating to residential conveyancing.

We have a large conveyancing team, providing an excellent and timely service. Regardless of who works on your matter, they will be supervised by Associates, Senior Associates and the Head of the department, Caroline Walton. If you instruct us to act for you then you will receive additional information about those dealing with your matter in our letter of engagement. The members of the team and their profiles can be located here.

Please click here if you would like one of our property experts to contact you.